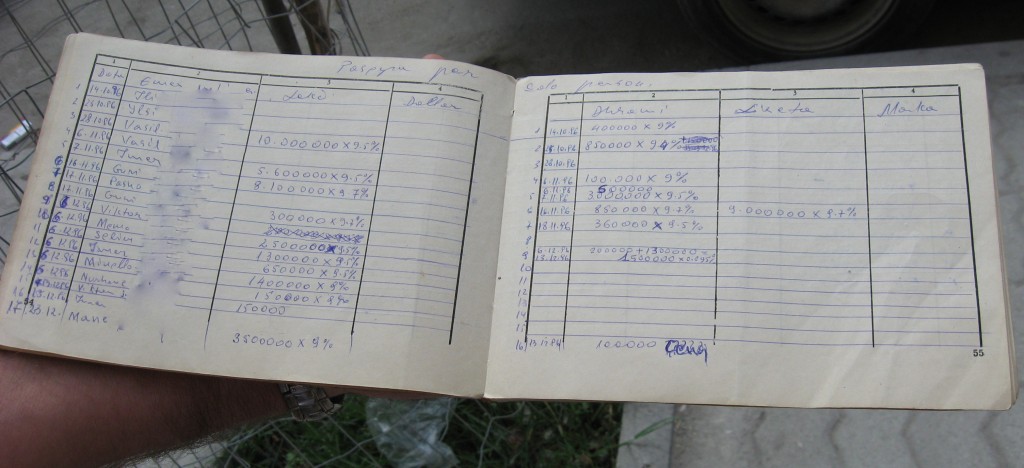

A book of records from a former sekser (broker) listing names of former creditors, amounts deposited in the pyramid schemes Gjallica and Cenaj. As the records indicate, the sekser managed deposits in Albanian lek, Greek drachmas, Italian liras, and German deutschmarks. Photo by Smoki Musaraj (Last names of former creditors have been blurred to protect their anonymity)

Explore the Albanian Ponzi Archive here.

See blog posts about Tales from Albarado: “Ethnography of a Ponzi Scheme” (Cornell University Press blog) and “Money and Speculation in Times of Crisis” (Institute for Money, Technology, and Financial Inclusion blog).

In early 1990s Albania, about a dozen firms, locally referred to as pyramid firms (firma piramidale), emerged at a time of deep economic, social and political transformation following the dissolution of the command economy and the rapid embrace of postsocialist free-market reform. The firms attracted 1.5 million investors in a country of about 3 million people. When they collapsed in 1997, the country fell into anarchy and a near civil war. Tales from Albarado revisits these times of excitement and loss in order to gain a better understanding of how people from all walks of life came to invest in these financial schemes and how these schemes became intertwined with everyday transactions, dreams, and aspirations. Based on oral accounts by former investors and brokers to the firms and archival media research, I argue that the Ponzi logics of accumulation prevalent in postsocialist Albania emerged out of a specific historical moment and were thus intricately connected to the major political and economic transformations of the end of the twentieth century. Situated at the margins of the emerging global markets of post-Cold War Europe, the Albanian firms nonetheless represent an economic reality that continues to plague capitalist economies: speculative bubbles.

This ethnographic take on the Ponzi logics of accumulation prevalent in postsocialist Albania calls attention to forms of credit expansion and speculative finance from below (rather than through top-down financialization). Following the trajectories of various objects of wealth that participants circulated through these firms—among others, multiple currencies, privatization vouchers, remittances, and recently privatized apartments—the book outlines key pathways of value transformation across local and transnational markets and social networks. The book also identifies strategies for transforming, creating, and converting value through the pyramid firms. I argue that the pyramid firms provided an alternative means of saving, investing, and multiplying wealth for people located at the margins of global capital. As such, these financial practices provide insight into the multiple and diverse economies that proliferate within neoliberal regimes, while also being other to neoliberal logics, institutions, and practices.